TV Streaming Services: 92% of Free Subscribers Have Paid Subscriptions, 70% OK with Ads

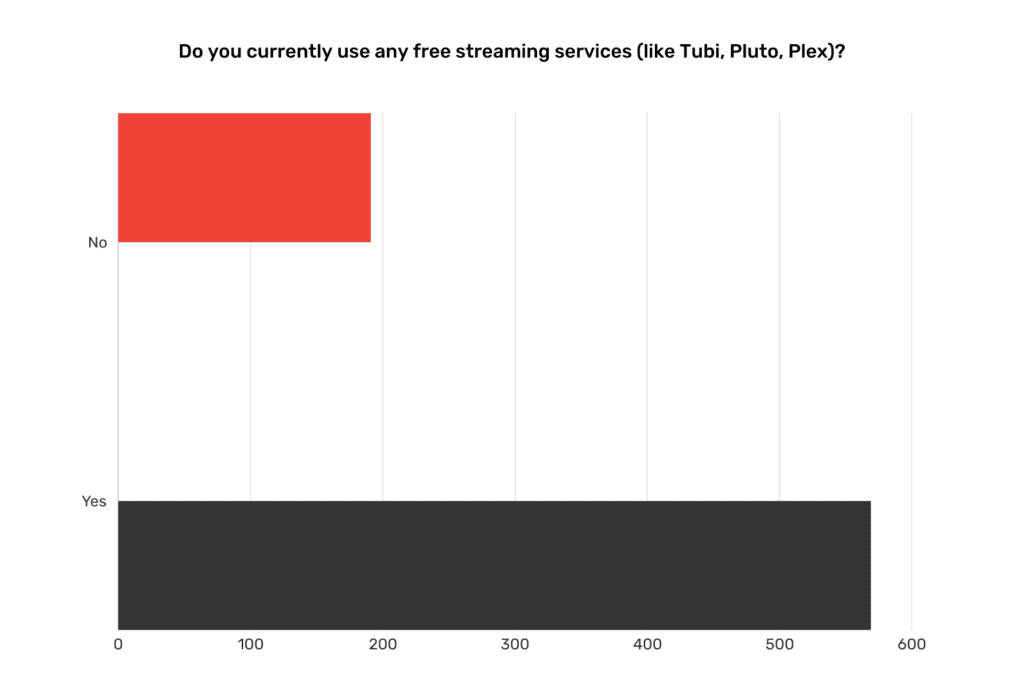

With 60% of US households accessing Free Ad-Supported Streaming TV (FAST) in 2023, platforms like Tubi and Pluto TV boasting millions of monthly active users, and 67% of US households had a paid TV subscription in 2021, down from 76% in 2020, the potential for reaching a broad and diverse audience appears enormous.

The Colling Media market research team conducted a national Snapshot Study on January 9, 2024, to understand the rise in consumer use of free TV subscription services. The study surveyed 500 adults 18+ from throughout the United States. It aimed to reveal consumers’ use and attitude toward FAST services versus paid TV subscription services.

Top-level findings of the Colling Media 2023 TV Streaming Snapshot Survey:

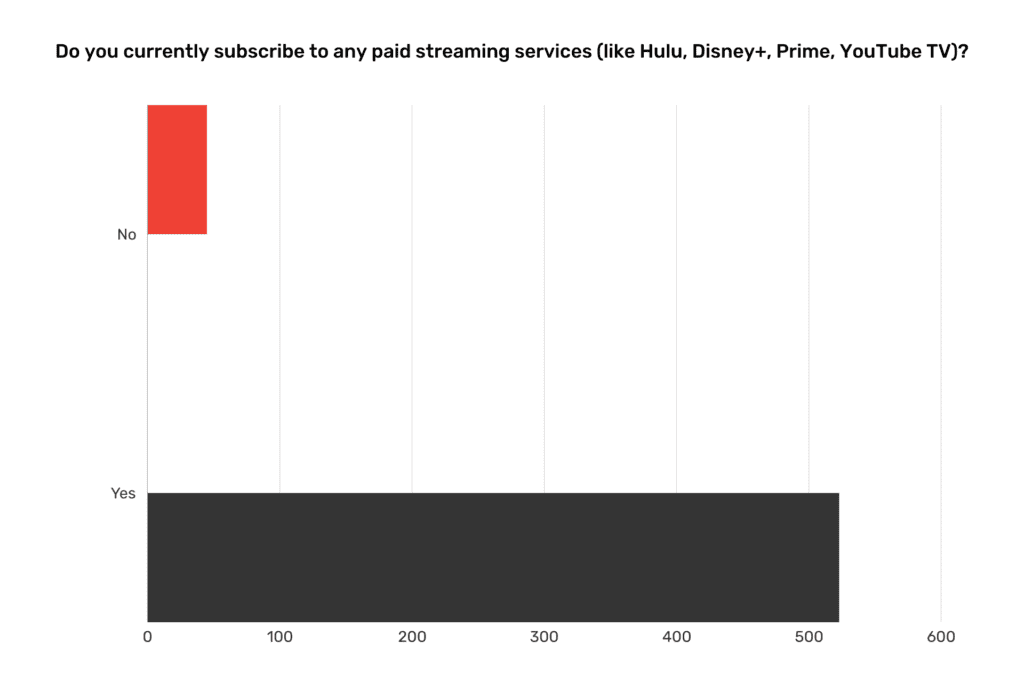

92.0% of free TV subscription subscribers also have a paid TV subscription service

93.0% of females and 91.0% of males subscribe to paid services

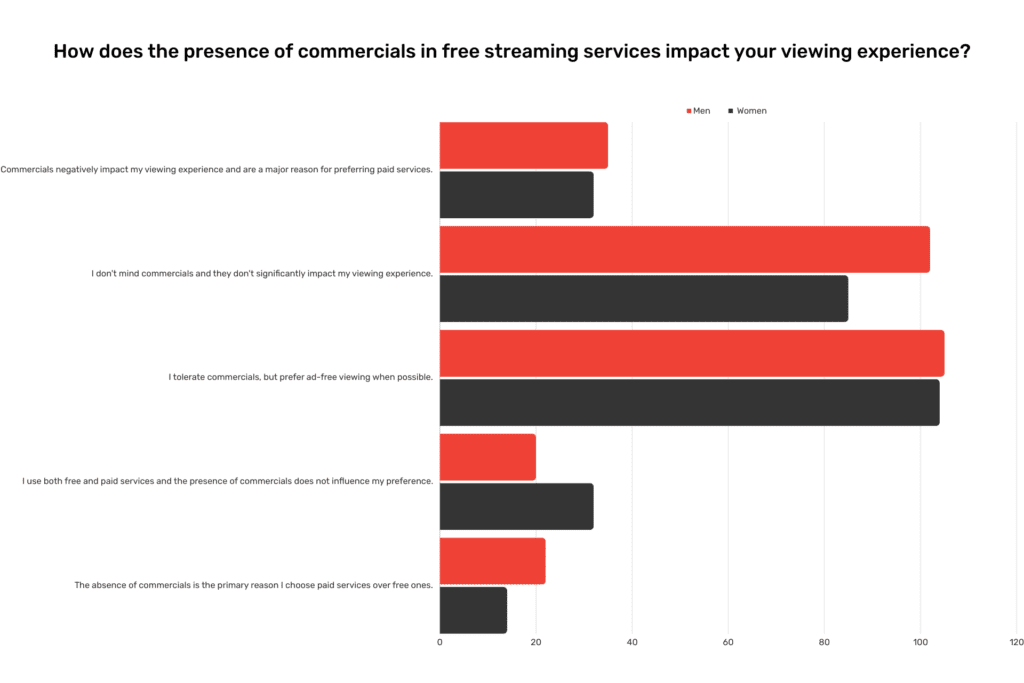

70.9% of respondents tolerate or don’t mind commercials

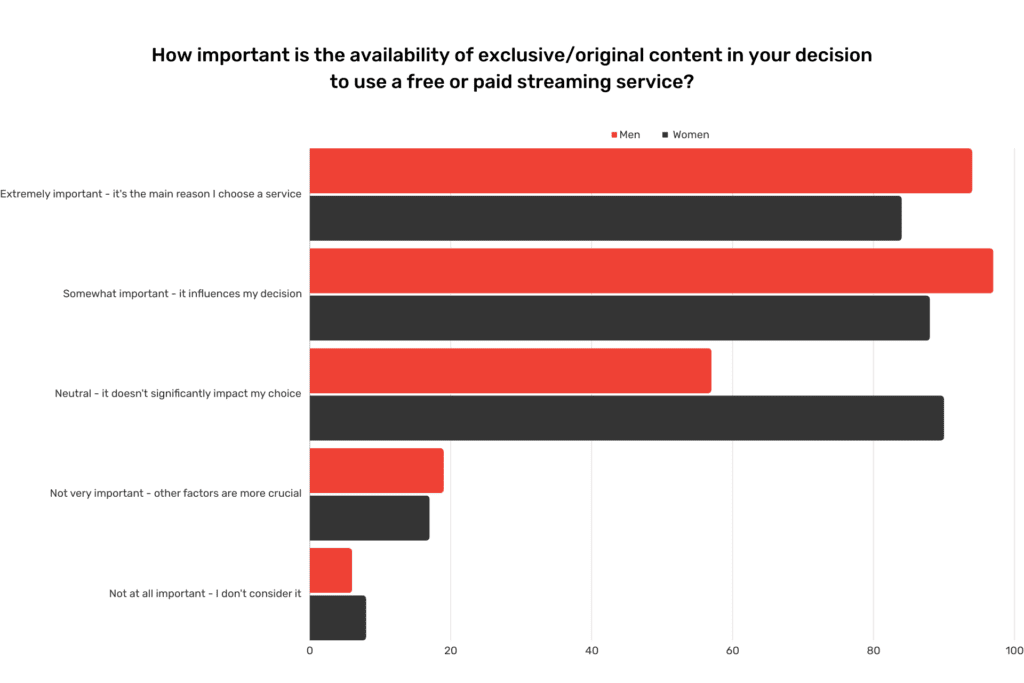

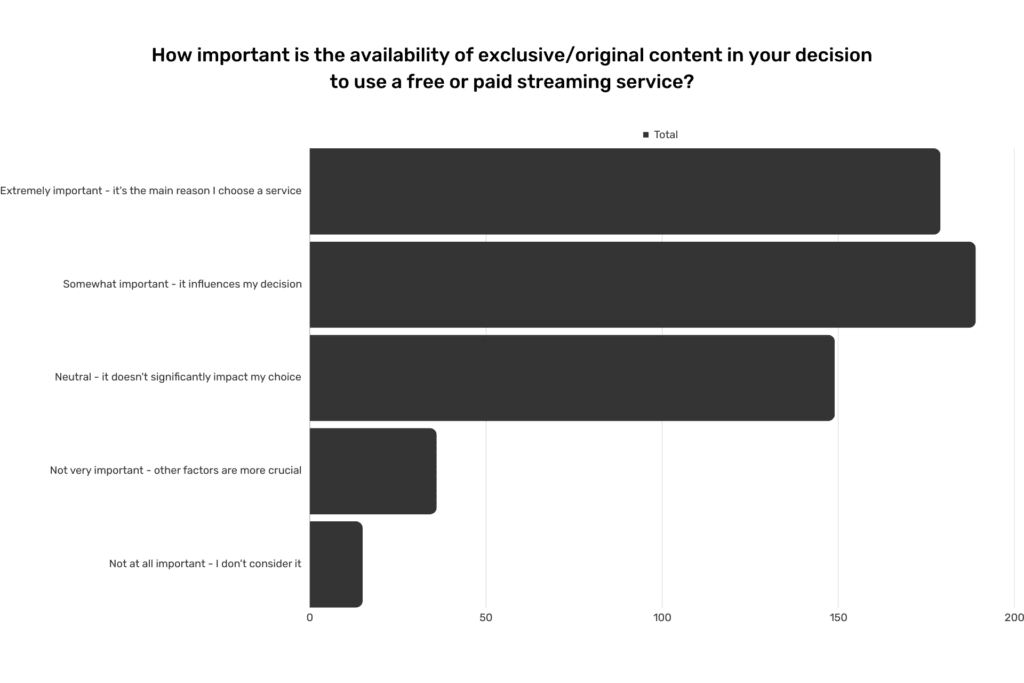

64.7% indicate exclusive content is extremely or somewhat important

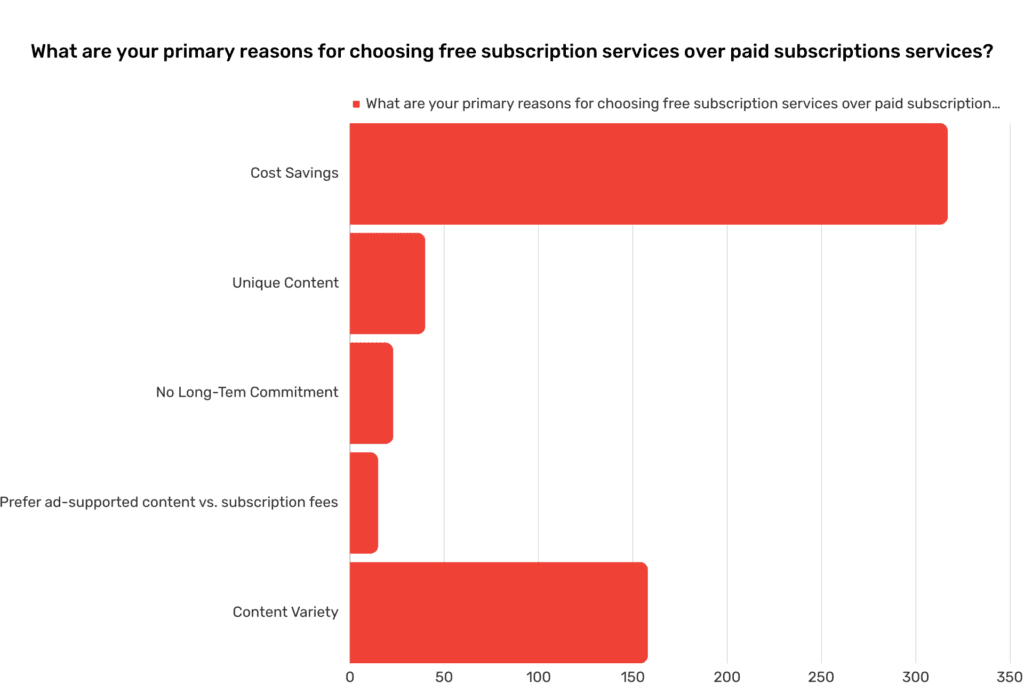

55.8% of respondents indicated cost savings as the main reason for subscribing to free TV services

In a landscape where paid subscriptions are declining, the shift towards free TV streaming services is unmistakable. Brands that can tap into this trend stand to gain significant visibility and engagement. The appeal of free TV streaming lies in its accessibility and the variety of content that attracts a wide demographic, offering a fertile ground for targeted and effective advertising.

Takeaways from the Colling Media 2023 TV Streaming Snapshot Survey

Brands should integrate FAST services with paid TV subscriptions into marketing to maximize reach. Capitalizes on the expansive audience of FAST platforms and the targeted demographics of paid services, ensuring comprehensive market coverage.

FAST services are popular among the pivotal 24-54 demographic for diverse and engaging content and are essential for effectively reaching this highly sought-after audience segment.

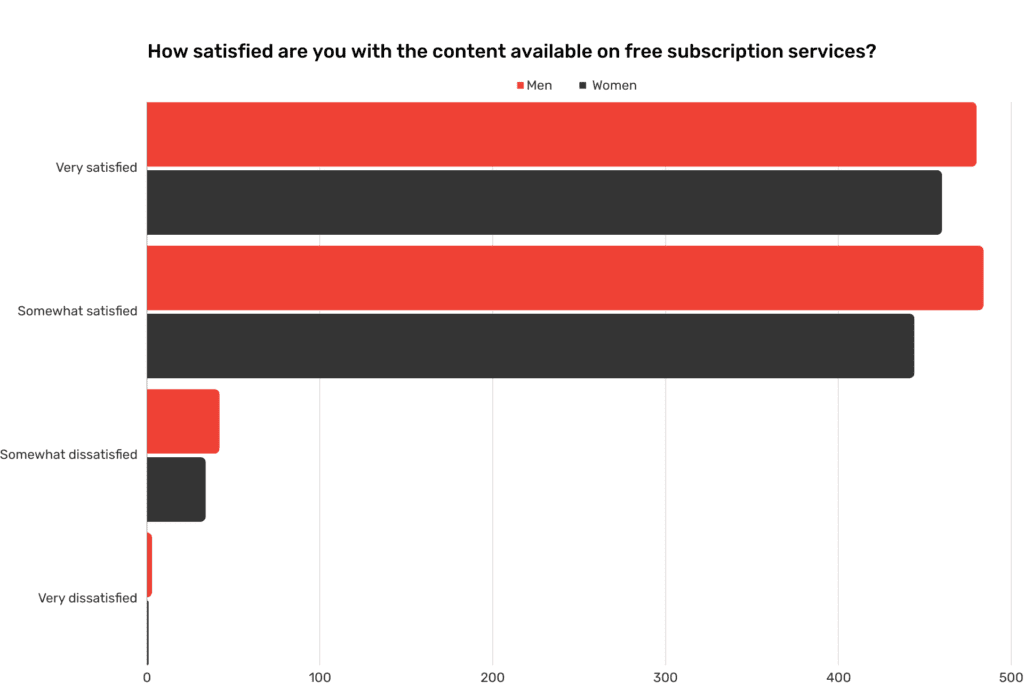

The attitudes of viewers toward commercials—37.5% tolerating but preferring ad-free viewing and 33.4% indifferent to ads—suggest that brands should be include free TV subscription budgets when planning campaigns.

With cost savings being the primary driver for 55.8% of free service users, there’s a clear opportunity for brands to align with value-centric messaging.

“The shift towards FAST services opens up another avenue for marketing directors looking to broaden audience reach,” says Brian Colling, CEO of Colling Media. “By strategically leveraging the exploding platforms, brands can tap into a diverse and growing viewer base.”

Disclaimer: The findings from this survey are subject to a margin of error of approximately ±4.38% at a 95% confidence level, indicating that there is a 95% probability that the true values in the overall population fall within this range of the survey results. It’s important to consider margins when interpreting survey data, as it reflects the potential variation between the sampled group and the broader population. The responses are indicative of the perceptions and behaviors of the respondents at the time of the survey and may not accurately predict future trends or changes in opinions.